Ramping Up Distributed Renewables Could Help Solve Perennial Load-Shedding Issues In Southern Africa

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News!

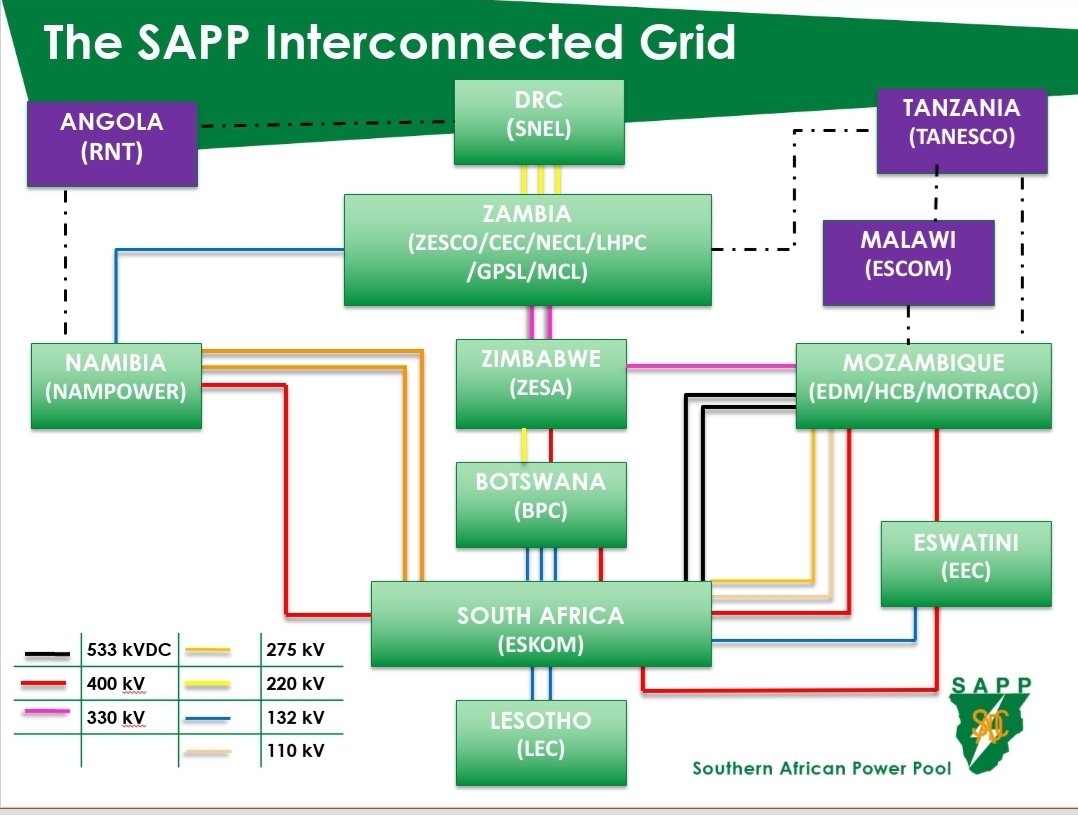

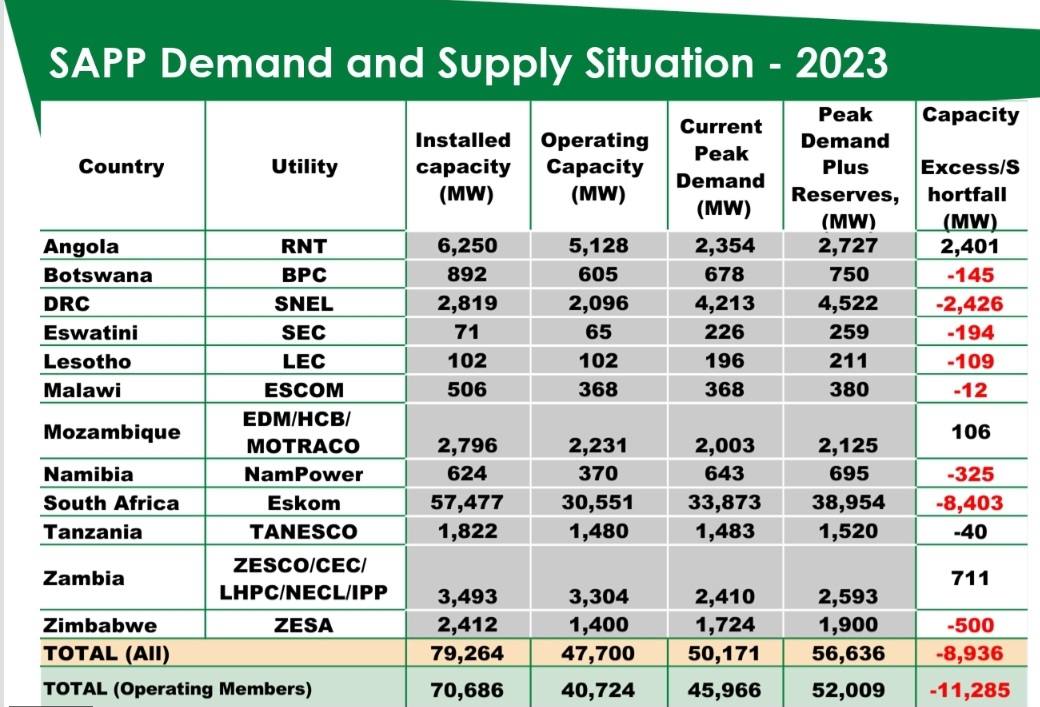

The Southern African Power Pool (SAPP) is the most active power pool in Africa. It is made up of 12 countries and home to 360 million people. The total installed generation capacity in the region is 80 GW. The peak demand in the region is 57 GW, however the available capacity is only 48GW according to the figures from the SAPP, leaving a huge electricity generation shortfall. The most affected member states are South Africa, Zambia, and Zimbabwe, where citizens face regular electricity rationing cycles known as load-shedding. `

The electricity generation mix in the Southern African Power Pool is dominated by coal. Coal’s share is at 59% (mostly from South Africa and places like Zimbabwe), followed by hydro at 24%, solar PV at 4%, distillate at 3.8%, then wind, nuclear (South Africa) at 3% and open cycle gas turbines at 2%.

The SAPP operates four competitive electricity markets between twelve member countries. It has facilitated trade between utilities in Southern Africa since 1995. The operating member countries include Namibia, South Africa, Lesotho, Eswatini, Zimbabwe, Botswana, Mozambique, Zambia, Malawi, and DRC, which are principally represented by each country’s national utility.

A recent presentation by Eng. Alison Chikova, Chief Engineer at the Southern African Power Pool shows that 9 countries are currently interconnected at transmission level with 3 countries not yet connected to the SAPP grid. Malawi is connected through the Mozambique – Malawi Interconnector and Tanzania is being connected through the Zambia – Tanzania Interconnector which will lead to interconnection of SAPP and the East African Power Pool as Tanzania is also being connected to Kenya. Angola will be connected to Namibia, DRC, and Zambia.

SAPP’s Trading arrangements are meant to fulfill the vision of SAPP, which is to:

- Facilitate the development of a competitive electricity market in the Southern African region.

- Give the end user a choice of electricity supply.

- Ensure that the Southern African region is the region of choice for investment by energy intensive users.

- Ensure sustainable energy developments through sound economic, environmental & social practices.

- STEM was initially used in SAPP and currently DAM system is being used. The pool moved from a cooperative to a competitive pool

SAPP Markets

Bilateral Market- Bilateral Trading Objectives are mainly to meet long-term demand and supply balance

- Trading arrangements mutually agreed between bilateral parties

- Volumes and prices are the key parameters

- Transmission path to be secured in advance

- Can be firm or non-firm

- Firm contracts

- Have penalties for non-delivery and

- Generally, not interruptible – reliability premium

- Non-Firm contracts

- Are interruptible with notice

- If notice given, no penalties

- Generally, less than 75% reliable.

- Firm contracts

Forward Physical Markets — Competitive trading in monthly or weekly contracts (or any other defined periods longer than one day ahead) for future delivery according to the contract specifications.

The following energy contracts may be traded:

- FPM-Monthly trades hourly energy base-load contracts for each of the 24 hours of all days in the following month.

- Hourly energy base-load contracts for the following time-of-use contracts with different hourly patterns valid for all days in the following month

- Off-peak hours

- Non off-peak hours

- FPM-Weekly trade’s hourly energy contracts for the following time-of-use contracts with different hourly patterns valid for all days in the following week:

- Off-peak hours

- Peak hours

- Standard

Day Ahead Market –– The regional market established within the SAPP with the objectives to trade electricity a day in advance of the delivery of such trades.

- Hourly energy contracts for each of the 24 hours of the following day, or a future day.

Intra Day Market — The IDM is a continuous market, and trading takes place every day around the clock until one hour before delivery. Prices are set based on a first-come, first-served principle.

- Hourly energy contracts for one or more hours for periods as specified by the SAPP Market Operator.

The persistent load-shedding issues plaguing South Africa, Zambia, and Zimbabwe could be solved by unlocking the full potential of the Southern African Power Pool as well as the East African Power Pool once it is fully activated. This is why it’s important to prioritize and accelerate planned interconnections between Tanzania and Zambia as well as Angola’s to Namibia, DRC, and Zambia. Looking at table below from SAPP, Angola had excess capacity of around 2.4 GW. Some of this could be taken up by other members of the SAPP as required to alleviate some of the shortfalls.

Recently, Tanzania announced that it was curtailing generation from some of its hydropower plants due to excess generation capacity as a result of the heavy rainfall so far this season. This excess capacity could have been quite valuable had it been injected into the SAPP. As Tanzania is also going to be linked with Kenya, with Kenya connecting with Ethiopia, Ethiopia’s hydro resources could also be quite valuable for the SAPP and the East African Power Pool once it is fully active.

In the medium to long term, Kenya, and Ethiopia’s wind potential as well as Kenya’s great geothermal potential could also be unlocked to add valuable renewables into the mix for the East African Power Pool as well as feeding these into the Southern African Power Pool. All the member states of the SAPP will of course also need to ramp up any of their own electricity generation projects that will cumulatively help to bridge the current generation shortfall of at least 11GW.

While the larger generation projects can participate in the Southern African Power Pool, there is also an incredible opportunity for thousands of small distributed renewable power projects such as small hydro plants and rooftop solar in the C&I and residential sector to contribute to the local energy mix of each of these countries. We have seen just how much impact rooftop solar can have in places like Australia where there are over 3 million homes with rooftop solar. Rooftop solar now accounts for 11.2% of Australia’s electricity supply, with households and businesses playing a leading role in Australia’s renewable energy transition, according to the Clean Energy Council’s new Rooftop Solar and Storage Report. 2.9 GW of rooftop solar from 314,507 units was installed in Australia in 2023, and rooftop PV surpassing 20 GW of total installed capacity in Australia.

Closer to home, we have also seen just how quickly distributed solar plants can add some good capacity. In South Africa, 3 GW of solar in the C&I and Residential solar sectors was added in just over a year from March 2022 to June 2023.

Another critical area to focus on for member states of the SAPP to focus on is increasing electricity access for their citizens as none of the member states are yet to achieve universal access to electricity for their citizens. Access to electricity is still quite low with a lot of the member states still below 50%. There is a lot of work to be done in this regards and therefore accelerating and expanding planned interconnection projects as well as accelerating planned generation projects including distributed renewables will go a long way in increasing access to electricity.

Have a tip for CleanTechnica? Want to advertise? Want to suggest a guest for our CleanTech Talk podcast? Contact us here.

Latest CleanTechnica.TV Video

CleanTechnica uses affiliate links. See our policy here.